The world of retirement account and planning can get very confusing, with multiple types of accounts, limits, usability, etc. It leaves many people in the dark, hoping they are getting the best tax advantages on the choices offered. Most companies will have some type of retirement account available, and people know of the need to save for retirement, but after those two simple facts, many are left hoping they will have enough in retirement, and are saving in taxes somewhere along the line! It becomes very important to seek tax consulting and/or some level of financial planning, but at least to know the options and benefits of each type of retirement account.

To help a little bit, here’s a look at 5 popular retirement savings options and, of course, the tax benefits each offers.

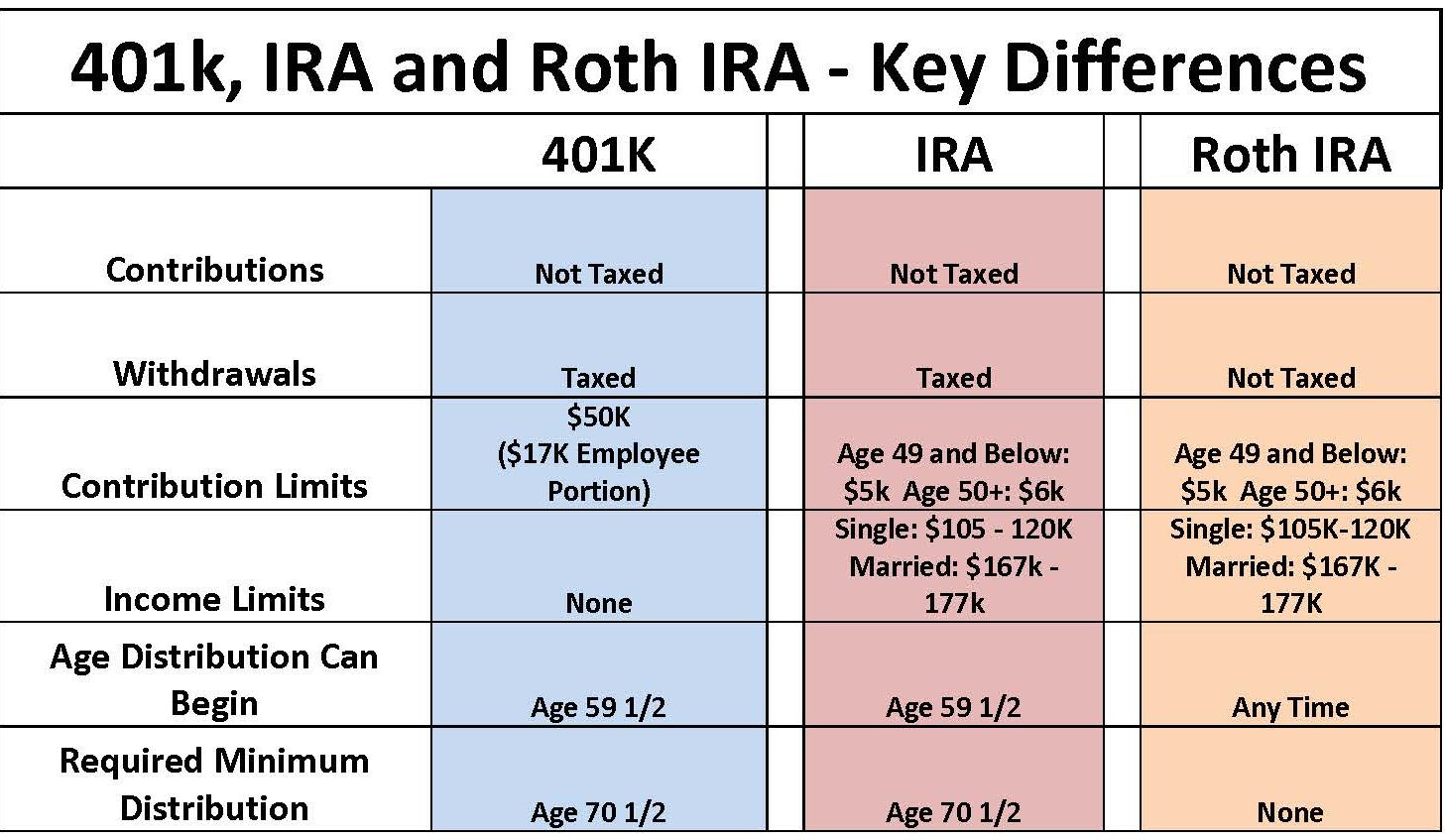

1. Traditional IRA: An IRA is a tax-favored retirement account which you put money that grows until you’re ready to use it in retirement. With a traditional version of an IRA, your contributions are tax deferred. That means you don’t pay any taxes on your investment earnings. This benefit can be a major deal, depending on dollar amount invested, and investing success. With the market being hot the last few years, the tax savings can be substantial!

Depending on your income and whether you have a retirement account at work (or, if you’re married, your spouse’s workplace retirement option comes into play here, too), you might be able to deduct your IRA contribution from your annual taxes.

You are limited in how much you can put into your IRA each year, with older savers getting to make a $1,000 catch-up contribution.

And eventually you do have to pay tax on your retirement money when you withdraw it at 59½ or older. And when you turn 70½ you must take a required minimum distribution (RMD). As the name indicates, this is at least as much as Internal Revenue Service calculations say you must take out of the tax-deferred retirement account so that Uncle Sam can finally get his tax cut.

2. Roth IRA: A Roth IRA also allows you to put an annual amount into this tax-favored retirement account, again with older folks getting to add more. But the money that goes into a Roth is already taxed. That means no tax deduction on the contributions.

But the tax code makes up for that by allowing you to withdraw your Roth IRA money in retirement tax-free. Even better, you can take it out on your timetable. There’s no RMD for a Roth.

Because of the tax-free component, Roth IRAs are great for young workers starting out, who can contribute over their entire career and never worry about paying tax on the retirement funds.

Many people have a combination of the above, depending on workplace, and personal situation. Since all of these are part of lifelong financial planning, it’s a good idea to start thinking about this early.

3. 401(k) workplace defined contribution plans: These are contributions, mostly yours, that go into a savings account at work which get tax benefits to encourage you to save for retirement.

These commonly are called 401(k) plans if you work for a for-profit company. If you’re employed at a nonprofit or are a teacher, this type of workplace retirement account typically is referred to as a 403(b). Similar accounts for government workers are called 457(b) plans.

Regardless of the tax-code section that provides these retirement options with their names, these accounts let you contribute a portion of your pay before taxes are taken out each pay period. That helps lower your tax bill since there’s less money to be taxed. That 401(k) money then grows tax-deferred.

While you are primarily responsible for shoring up your 401(k), many employers match their workers’ plan contributions, typically up to 6 percent. Make sure you contribute enough to get your company match. If you don’t, you’re basically throwing away free retirement money.

Some companies offer a Roth 401(k). As with IRAs, the money you put into a Roth workplace plan is already taxed, meaning its earnings grow tax-free. But, as with the Roth IRA, as long as you meet the withdrawal rules, your earnings in a Roth workplace retirement plan are tax-free.

4. Self-employment retirement plans: If you work for yourself, you probably are focused on making your business or freelance effort a success. But you also need to look to the day when you won’t be the boss any longer. That means opening and contributing to a self-employed retirement plan.

One of the easiest options for a sole proprietor is a SEP (for simplified employee pension) IRA. A SEP IRA operates essentially like a traditional IRA for tax purposes. You contribute a portion of your income to your retirement account and fully deduct them from your income taxes. The maximum annual contribution limits are higher than many other tax-favored retirement accounts. Plus, once created, SEP IRA administrative responsibilities are minimal.

Other popular self-employed retirement plane include SIMPLE (for Savings Incentive Match Plan for Employees) IRA and a solo 401(k).

Quick reference on the basics retirement accounts and tax return implications:

If you would like to see some scenarios, see comparison calculator here:

5. Health savings account (HSA): Yes, this is a savings account connected to your medical insurance, specifically a high deductible health plan (HDHP). But this health-related account can provide another way to save for retirement.

Those with certain high-deductible policies can save money tax-free in an HSA. These funds help you cover the larger deductible portion of the associated medical coverage. The HSA is yours to keep even if you no longer have the HDHP or make contributions to the account.

Why hold onto an HSA? From a medical perspective, you can still use the HSA money to reimburse yourself tax-free for qualified medical expenses until the account is empty.

And once you turn 65, it essentially becomes a retirement account. You can withdraw your HSA money for any reason without penalty. You will, however, have to pay income taxes on money.

Finally, don’t confuse HSA with FSA, a flexible spending account. Although both are related to medical expenses and offer tax breaks to the account owners, they are very different.

Inflation factors into retirement accounts: In most cases where you get a tax break for contributing to your retirement, the IRS sets limits on how much you can put into the accounts.

The amounts are adjusted each year, usually in the fall, for inflation. The 2019 figures were released October 31, with slight increases to account for inflation.

This year’s retirement plan inflation changes were issued before the Tax Cuts and Jobs Act (TCJA) was enacted, but those 2018 amounts weren’t affected by the tax reform law.

The HSA inflation information is on a different schedule, usually coming out in the spring. Still, new TCJA revisions forced the IRS to change, then change back, the 2018 HSA and HDHP limits.

The main most important thing to do is understand your options, and have a plan. We understand that things change in life, new job, kids, etc, but even a conservative savings plan is very beneficial, not only for immediate tax savings, but long term.